Claim up to RM 20000 in Income Tax Rebate from PENJANA. Form B deadline.

Types Of Visa In Malaysia Malaysia Small Business Ideas Visa

The lower cost for setting up the company.

. In Malaysia there is no distinction between the natural person who owns the sole proprietorship and the business. A PAN card for the proprietor. In Malaysia what exactly is a sole proprietorship.

Whatever you pay yourself either in the form of. The overall simplicity of execution. The structure itself is simple to form.

In Malaysia the tax authority collect taxes from sole proprietorship and partnerships upfront. To do this you will need to. How do I file taxes as a sole proprietor.

As such sole proprietorships also fall under their jurisdiction. Within All Malaysia Government Websites. Lets assume that Janet switches her sole proprietorship to JM in 2020.

Registration under the Shop and Establishment Act of the relevant state. The upfront tax estimate will be payable bi-monthly in 6 instalments. Below are the documents required when filling in Form C to apply to close a Sole-Proprietorship or Partnership.

Form B is submitted by individuals with business income other than employment income for example sole proprietorship or partnership. Provide professional advice related to your business set up operation and Malaysia rules compliance include company incorporation accounting payroll and etc. For Sole Proprietorship a checklist is necessary.

Please select one of. Additionally setting up a sole proprietorship still allows an. MalaysiaBiz is a one stop center to manage business registration and licensing in Malaysia.

Prime Minister Muhyiddin Yassin declared. The SSM of Malaysia enforces the Companies Act 2016. Photocopy of owner andor partners identity.

The reasons for this are. Sole proprietors are required to complete two forms in order to pay their federal income tax for the year in question. The lower amount of paperwork.

The first thing you need to do when setting up a sole proprietorship is to go through the registration with the SSM Companies Commission Malaysia. A sole proprietorship is a structure most local businessmen tend to venture into. Sole proprietorship From the tax perspective there is no separation between you as an individual and you as a sole proprietor.

As mentioned before the sole.

Obtaining A Computer Card In Qatar Cards Initials Business

5 Important Things To Know About Sole Proprietorship In Malaysia Trustmaven

Economy Of Malaysia Economic Outlook History Current Affairs Malaysia Economy Outlook

Accounting Malaysia Importance Of Financial Statement By Beyondcorp

Malaysia Personal Income Tax Guide 2022 Ya 2021

Income Tax For Sole Proprietors Partnership In Malaysia 2020 Updated

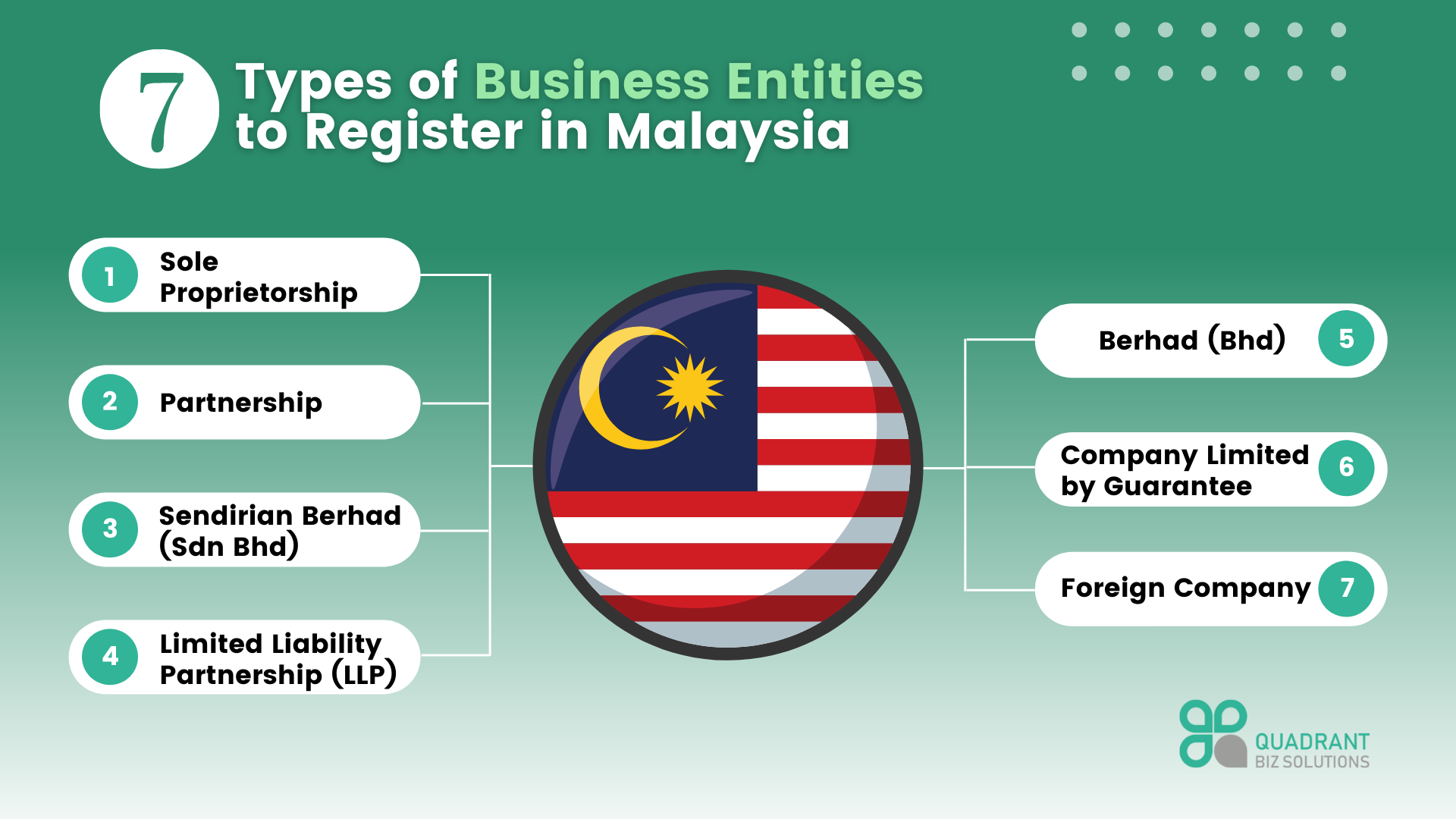

Understanding Business Entities In Malaysia Quadrant Biz Solutions

Legal Steps For The New Company Incorporation In India Corpbiz Private Limited Company Limited Liability Partnership Aadhar Card

Tax Rebate For Set Up Of New Businesses L Co

Third Party Accounting Services In Singapore Makes You Completely Tension Free Accounting Services Accounting Bookkeeping Services

Company Secretary Bangladesh Company Registration Process In Usa Company Secretary Consulting Firms Kong Company

Company Formation In Switzerland

Follow These Important Steps To Register A Company In Malaysia

Tax Computation Template And Techniques For Partnership And Sole Proprietorship Hk Account Q A

Wholesale Retail Trade Wrt License In Malaysia

Registering An Enterprise In Malaysia Enterprise Success Business Consulting Business